capital gains tax changes 2022

Currently the capital gains tax rate for wealthy investors sits at 20. Capital Gains Tax Spring Budget 2022.

The Minimum Income Necessary To Afford A Five Million Dollar House

As of now the tax law changes are uncertain.

. The CGT annual exempt amount therefore remains frozen at. The new tax laws proposed in April 2021 would eliminate the step-up exemption on any inherited asset that has gained more than 1 million in value between purchase and death. Capital gain tax changes.

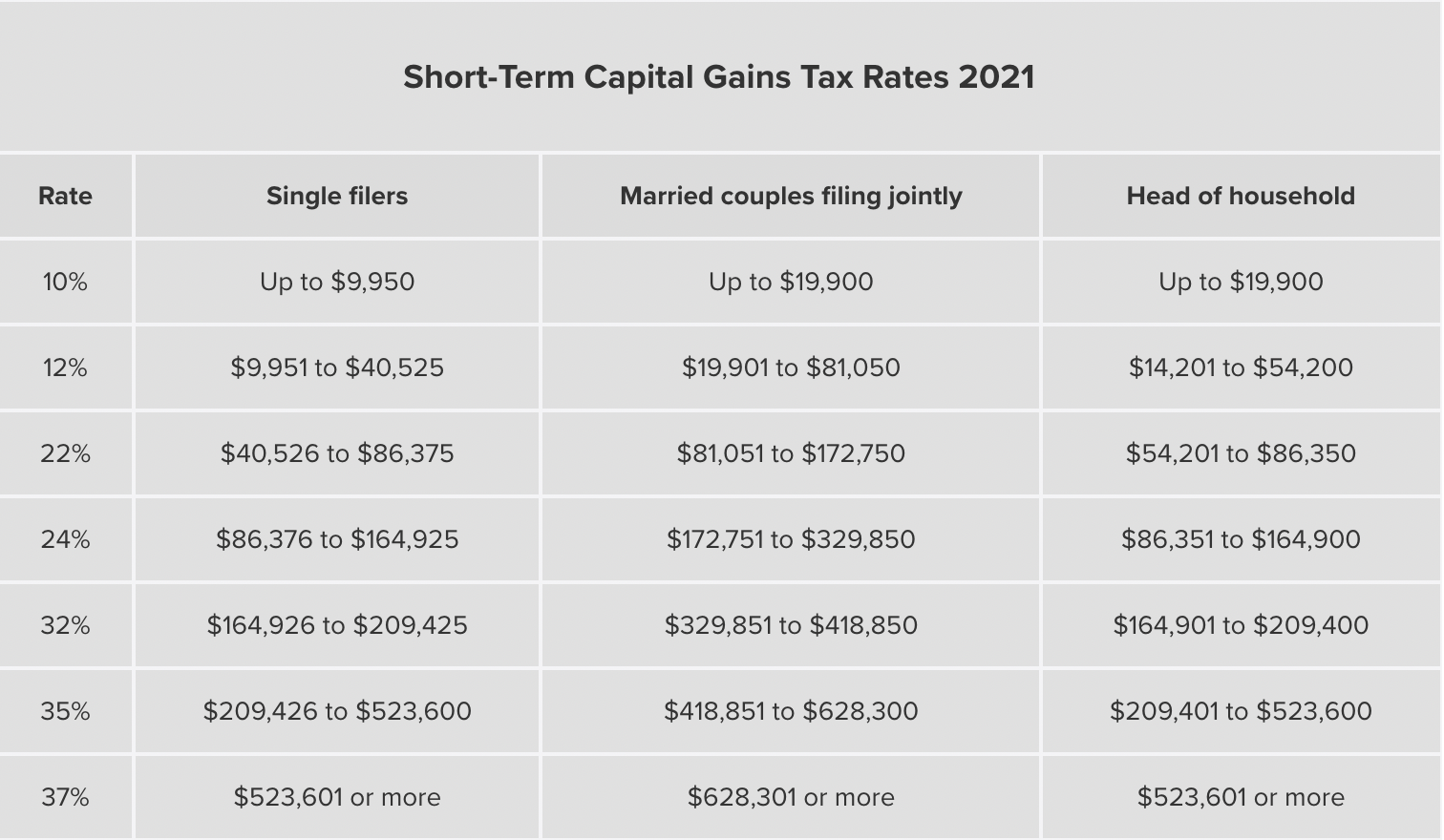

250000 of capital gains on real estate if youre single. Short-term capital tax gains are subject to the same tax brackets for ordinary incomes taxes. Following a simplification review Capital Gains Tax CGT is an area that we have been expecting to hear some major announcements in but the Chancellor decided to leave things as they are with no changes being announced in the Spring Budget.

This may allow you to pay less tax on the income. These changes may be significant and have large ramifications for your investments. One of the areas the government is looking to increase its tax collection from is capital gains.

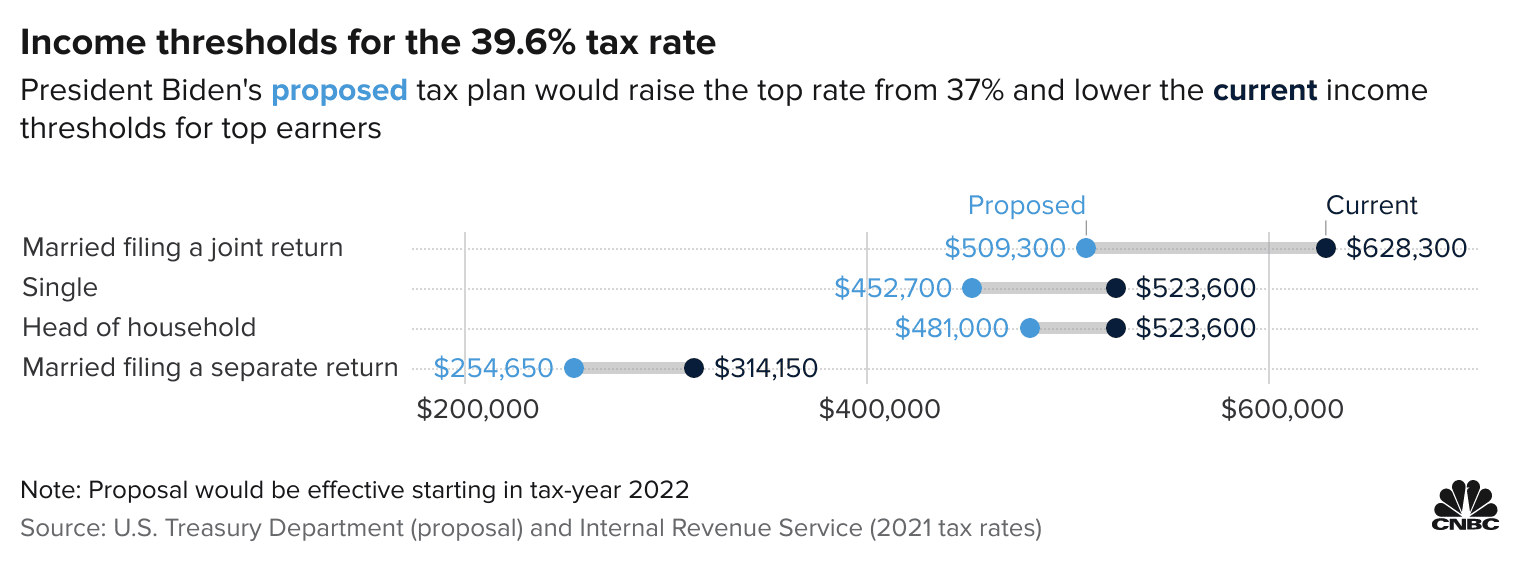

The proposal is bumping this up to 396. Nonetheless many sellers are looking to secure a sale before 2022 because of the possibility that any sale following 2022. Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still very possible for the budget in 2022 or in future years.

Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a. Tom talks all things capital gains tax rates in this weeks podcast. President Biden recently announced his plan to double the long-term capital gains tax rate for those at the top from 20 to 40.

In Spring Budget 2021 Chancellor Rishi Sunak announced that the income tax thresholds including the personal allowance would be frozen until 2026. While It Is Unknown What The Final Legislation May Contain The Elimination Of A Rate Increase On Capital Gains In The Draft Legislation Is Encouraging. He covers common misconceptions regarding capital gains taxes.

Tax increases in 2022 If youre selling your privately held company a key consideration may be closing the transaction before January 1 2022 when new tax increases are likely to take effect. Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021. Here are the key personal taxes and tax changes you need to know in 202223.

Now that 2021s tax deadline has passed its time to start looking for changes to make as we head further into 2022. Previously there had been a window of just 30 days for taxpayers to report the gain and pay the tax owed as of the Budget on 27 October 2021 this was immediately increased to 60 days. Capital Gains Tax.

This means youll pay. Income tax and personal allowance. Starting in 2022 at least a portion of Long Term Capital Gains LTCG and Qualified Dividends will be taxed at ordinary tax rates for those whose adjusted gross income is more than 1 million.

In his April 28th 2021 speech introducing the proposal President Biden explained Ending the practice of stepping. A new top long-term capital gains rate of 25 will replace the current 20 rate. 500000 of capital gains on real.

In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in. The five changes for 2022 that you need to know about AS MILLIONS of Britons make the most of the new year to get on top of their finances people are being reminded of some big. One large reason for the influx in property sales is the projected increase in capital gains taxes for 2022.

As 2021 draws to a close many commercial real estate investors are looking to sell. As part of the Austrian Eco-Social Tax Reform 2022 Ökosoziale Steuerreform 2022 the taxation of cryptocurrencies in Austria is now included in the existing tax regime for capital assetsThe Eco-Social Tax Reform 2022 was passed by the National Council of Austria on 20 January 2022 and published in the Federal Law Gazette on 14 February 2022. Joe Biden says this tax increase funds.

4 rows SEE MORE Tax Changes and Key Amounts for the 2021 Tax Year However which one of those. This is a lower income level than the 20 rate takes effect now. The higher rate will take effect at 400000 for single filers 450000 for married filing jointly.

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. The capital gains tax allowance has also been frozen at its. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

4 rows Although the capital gains tax rates for long-term investments which are those youve held. Capital Gains Tax Rate 2022. Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property.

For example if a taxpayer made 900000 from their salary and 200000 from LTCGs then 100000 of the LTCG would be taxed at the favorable 20 rate while the. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. The IRS typically allows you to exclude up to.

Capital Gains Tax Rate Increase 2022. There is a change on the horizon which can take place as soon as 2022. What proposed changes to the capital gains tax affect estate planning.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Short Term Vs Long Term Capital Gains White Coat Investor

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Capital Gains Definition 2021 Tax Rates And Examples

Will Selling My Home Affect My Medicare Clearmatch Medicare

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Capital Gains Tax What Is It When Do You Pay It

Short Term Vs Long Term Capital Gains White Coat Investor

Capital Gains Tax Changes For 2022 Personal Finance Finance Express Co Uk

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)